Home › Market News › FOMC Expected To Raise Rates This Week

The Economic Calendar:

MONDAY: 3-Month Bill Auction, 6-Month Bill Auction

TUESDAY: FOMC Meeting Begins, Existing Home Sales, 52-Week Bill Auction, 20-Yr Bond Auction

WEDNESDAY: MBA Mortgage Applications, EIA Petroleum Status Report, 4-Month Bill Auction, FOMC Announcement, Fed Chair Press Conference

THURSDAY: Jobless Claims, Chicago Fed National Activity Index, Current Account, New Home Sales, EIA Natural Gas Report, Kansas City Fed Manufacturing Index, 4-Week Bill Auction, 8-Week Bill Auction, 10-Yr TIPS Auction, Fed Balance Sheet

FRIDAY: Durable Goods Orders, James Bullard Speaks, PMI Composite Flash, Baker Hughes Rig Count

Futures Expiration and Rolls This Week:

TUESDAY: Last trading day for April (J) Crude Oil futures

WEDNESDAY: Last trading day for March (H) Interest Rate futures

Key Events:

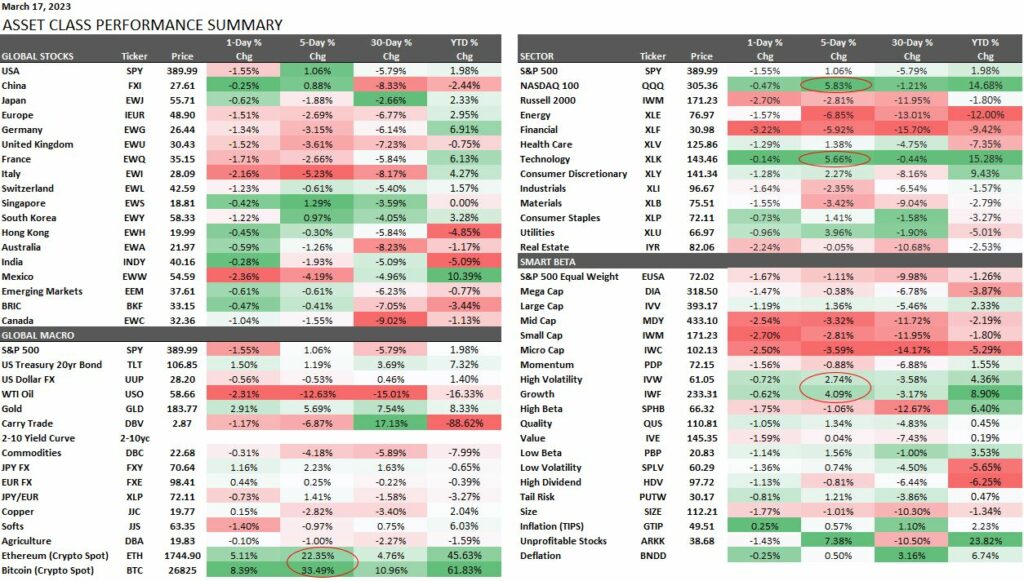

It was risk-off trade on the quad-witching Friday, with all major U.S. equity indices closing in the red as banking fears continued. However, the S&P 500 and Nasdaq rose by 1.06% and 5.8% on the week. The tech sector (XLK) was the strongest on the week by +5.6%, and growth stocks (IWF) were +4.09%.

It was a volatile week navigating the fallout from the Signature bank and Silicon Valley bank failures. In addition, on Thursday, 11 U.S. banks stepped in to rescue First Republic Bank with bank deposits totaling $30 billion.

Fears about the stability of banks European banks lead the Swiss National Bank to throw a lifeline of $50 billion to Credit Suisse (CS). Over the weekend, the WSJ reported that UBS offered a lowball bid of $0.25 a share for Credit Suisse. This is about an 80% discount to where CS closed on Friday.

A few key short-term levels for the S&P 500:

Upside: 3995, 4045, 4090

Downside: 3920, 3895, 3845, 3800

The massive rally in bond futures prices came as a surprise to many traders. This is just as much of a “pain trade” as a banking “fear trade.”

Macro hedge funds, trend-following CTAs, and systematic strategies were hawkish and short bond futures, so unprepared for what ended up being one of the biggest and fastest bond rallies on record.

Following a hawkish speech by Chairman Powell in recent weeks, a 50bp hike at the upcoming March FOMC meeting was seen as the highest probability, along with much higher terminal rate expectations. That’s now a fringe case.

U.S. Treasury yields current yield compared to the last newsletter:

30-Year yield 3.63% vs. 3.71%

10-Year yield 3.43% vs. 3.70%

5-Year yield 3.50% vs. 3.97%

2-Year yield 3.84% vs. 4.59%

2-10 Yield spread -0.41% vs. -0.89%

The oil futures market liquidation seems related to traders expecting an economic recession and dampening demand. We saw the risk-off trade kick in last week.

The current supply-demand fundamentals paint a different picture. This is evidenced by a substantial drawdown in oil product inventories, as the American Petroleum Institute (API) reported that gasoline supply fell by 4.587 million and distillates by 2.886 million. A 946,000-barrel drop in Cushing, Oklahoma supply tempered the reported 1.155-million-barrel increase in crude oil supply.

Yet supply and demand for crude oil futures do not matter when we have a banking crisis. We expect the fundamental picture to be more balanced by the middle of the year.

Our take on this Wednesday’s FOMC decision:

As the U.S. banking crisis persists for the past five days, we see the “long panic” plays: bitcoin (BTCUSD) +33%, gold (GLD) 5.6%, tech stocks (XLK) 5.5%, and 20y govt bonds (TLT) 1.19%.

When these trades start to unwind, policy panic is working & crisis is over. Then, back to inflation-busting.

The price of Bitcoin (BTCUSD) rose 33% last week to $26825 and is higher by +61% YTD. While some traders say this to be a short-term bounce, a more significant price breakout seems imminent.

In the wake of last week’s U.S. banking crisis, traders have applauded the performance of cryptocurrency prices. They are performing as bitcoin creator Satoshi expected in his original white paper.

The bitcoin narrative is shifting on the possibility of a Fed rate pause. Inflation and Federal Reserve rate hikes are significant drivers of the price movements of Bitcoin.

Rate hikes can result in a boost in the U.S. dollar, which can render cryptocurrencies more expensive for foreign investors. If rates are cut, the opposite effect makes cryptocurrencies less expensive.

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

Our trading desk was fighting FOMO early in the week as some regional bank stocks rallied from lows and then doubled and tripled. But, by the end of the week, many of those stocks were back near lows.

FOMO, or Fear Of Missing Out, pushes you toward rash decisions. Be careful out there. Build a process and systems with rigid rules, and focus on what works.