Home › Market News › FOMC MINUTES, INTEREST RATES & CRUDE OIL FUTURES

The Economic Calendar:

MONDAY: U.S. Leading Economic Indicators (9:00a CST), Tom Barkin Speaks (11:00a CST)

TUESDAY: Existing Home Sales (9:00a CST), FOMC Minutes (1:00p CST)

WEDNESDAY: Initial Jobless Claims (7:30a CST), Durable Goods Orders (7:30a CST), Consumer Sentiment (9:00a CST)

THURSDAY: Thanksgiving Holiday – No Economic Reports Scheduled

FRIDAY: U.S. Services & Manufacturing PMI (8:45a CST)

Key Events:

Is this the start of a Santa rally? S&P 500 and Nasdaq-100 are higher +17.8% and 44.9% for the year. That’s historically a very good year.

We believe chasing longs here could be a late trade and would suggest using options to express views. Implied volatility is at attractive levels to structure both downside and upside trade structures.

The latest technical buying has squeezed the shorts. Over the last 10 days, CTAs have bought nearly $ 70 billion of U.S. equities, and this is the largest 10-day buying on record going back to 2016.

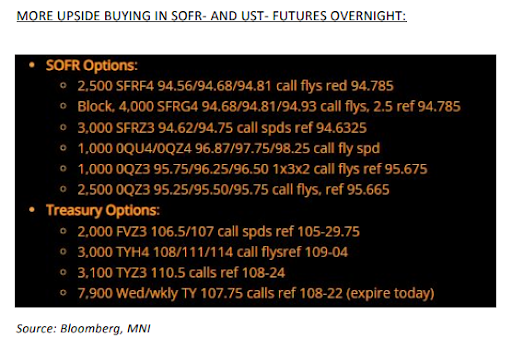

Markets are betting that the Fed is done with interest rate hikes. Traders remain extremely underpositioned in duration (longer-term 10y and 30y futures) and are still overpositioned in legacy “High for Longer” (1-2y futures). The market is reacting and pushing futures prices higher.

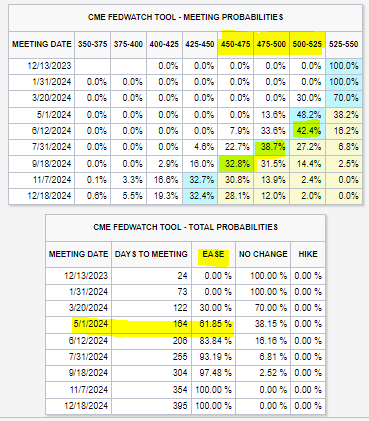

Fed Fund futures now show a 0% chance of additional rate HIKES, with rate cuts beginning in May 2024. Before last week’s CPI report, there was a 30% chance of at least one more rate hike.

Rate cuts were expected to begin in June 2024, and now markets are pricing in at least 4 rate CUTS in 2024. Take a look at the CME Fedwatch probabilities below, as well as some block trade flows.

Oil futures prices slumped last week, putting pressure on the OPEC+ group of major oil producers to consider extending and deepening production cuts when they meet in Vienna on November 26.

Hedge funds hold a near-record short position and control the market’s direction until proven wrong. The shorts are betting that OPEC won’t have the guts to add or extend production cuts and believe the U.S. will continue to break new oil production records despite declining rig counts.

Managed money is also betting that the U.S. won’t enforce sanctions on Iranian oil production and exports or will be able to cut back on Russia’s surging exports.

The market is getting extremely oversold, and prices are out of whack with what should be fair value based on current supply and demand fundamentals.

Many traders are expressing their upside view by using option call spread structures.

More alternatives to CME Exchange futures coming in January, when the CBOE launches margined BTC and ETH futures.

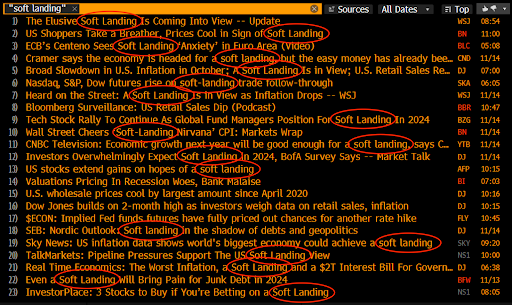

The “Soft Landing” narrative change may be a little premature. Mainstream media embraced this phrase after the CPI ticked lower than expectations.

Notice the headline on a Bloomberg terminal phrase search.

The House and Senate passed legislation to extend Fiscal Year 2024 government funding at last year’s levels into next year.

The bill took a two-tiered approach whereby the funding for some agencies was extended to January 19 and to February 2 for others.

Most Democratic lawmakers were pleased that the bill did not further reduce federal spending, while most Republican lawmakers favored the tiered deadlines since they believed they would help them force action on individual spending bills rather than one large spending bill.

Xi Jinping’s U.S. visit culminated in a friendly fashion last week, with China’s president receiving a standing ovation from corporate CEOs and other business leaders.

Xi declared that “there is plenty of room for cooperation” between the two nations, adding that “China is ready to be a partner and friend of the U.S.”

Our experience with newer traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks.

The emotional burden of trading is substantial on any given trading day. If you personalize these losses, you can’t trade.

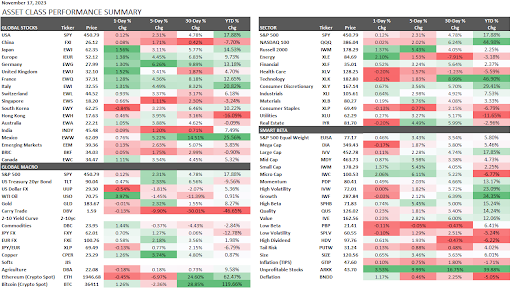

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.