Home › Market News › Stock Market Returns, Smart Beta, and Global Energy Themes

The Economic Calendar:

MONDAY: S&P Global Composite PMI Final (8:45a CT), ISM Services (9:00a CT), Mary Daly Speaks (9:00a CT)

TUESDAY: Balance of Trade (7:30a CT), Import/Export Prices (7:30a CT), Redbook (7:55a CT), Total Household Debt (10:00a CT), 3-Year Note Auction (12:00p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Used Car Prices (8:00a CT), EIA Petroleum Status Report (9:30a CT), 10-Year Note Auction (12:00p CT), Consumer Credit Change (2:00p CT)

THURSDAY: Jobless Claims (7:30a CT), Wholesale Inventories (9:00a CT), EIA Natural Gas Report (9:30a CT), 30-Year Bond Auction (12:00p CT), Thomas Barkin Speaks (2:00p CT)

FRIDAY: Baker Hughes Rig Count (12:00p CT)

Key Events:

The narrative has shifted. There are concerns now that the Federal Reserve has slowed down the economy too much and has not eased policy soon enough.

The Fed Fund futures market is now pricing in 196 basis points rate cut by August 2025, which averaged around 100 basis points for most of 2024.

We have also mentioned in previous weeks the rotation out of many popular stock market smart beta themes, such as momentum and Mag7 positioning.

The latest payrolls report has stoked recession worries, and traders will be paying closer attention to upcoming economic data.

Source: TradingView

Volatility is back. The VIX (CBOE Volatility Index) closed at 23.39, and the S&P 500 and Nasdaq-100 were lower BY -2.12% and 3.07% for the week, respectively.

Last week was marked by significant market volatility, primarily driven by weaker-than-expected economic data. The release of the July jobs report, showing a surprising slowdown in job growth and an increase in the unemployment rate, ignited concerns about a potential economic downturn.

This data led to a sharp decline in stock prices, with the tech-heavy Nasdaq entering correction territory. Bond yields plummeted as investors sought the perceived safety of government debt.

The market shifted from inflation concerns to the possibility of a more pronounced economic slowdown, prompting increased expectations for interest rate cuts by the Federal Reserve.

The earnings season continued with mixed results. Some tech giants reported strong earnings, but overall, the bar for earnings expectations had been set high.

Looking forward, traders are closely monitoring economic indicators and Federal Reserve policy for clues about the future direction of the market.

INTEREST RATE FUTURES

The interest rate market is in complete panic mode. Here are a few takeaways from last week.

Source: CME Fedwatch

We need to consider what happens to the stock market after the first Fed rate cut. Here are stats to consider when forming your trading thesis.

The Russell 2000 and S&P Equal Weight indices outperformed the broader S&P 500 and the Magnificent 7 groups last month.

Within the sector breakdown, Energy and Materials have performed well. Conversely, Information Technology and Communication Services have underperformed.

Among the style factors, Value and Low Volatility appear to have demonstrated positive returns. On the other hand, Growth and Momentum have exhibited negative returns.

Source: BofA

The Japanese Yen (JPY) Futures short-covering frenzy is fading. The rapid unwinding of Yen short positions that characterized recent weeks has shown signs of abating.

The JPY’s meteoric rise, catalyzed by escalating expectations of a BoJ policy shift, appears to be losing steam. Last week’s trading activity in JPY futures on the CME has reflected this cooling momentum.

While the market remains sensitive to any fresh cues on potential policy changes from the Bank of Japan, the initial shock of the hawkish pivot seems to have been absorbed.

The focus is now shifting towards assessing the potential economic implications of a tighter monetary policy stance and its impact on the broader FX landscape.

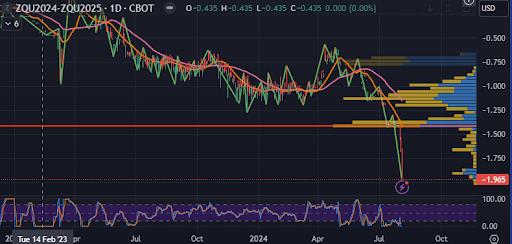

The uranium/nuclear power theme has exhibited volatility this past week, primarily influenced by production news, geopolitical tensions, and evolving nuclear energy policies.

While the underlying bullish sentiment driven by the global energy transition persists, near-term price movements have been more subdued.

Recent news of the world’s top uranium producer, Kazatomprom, reported higher first-half output and raised its production guidance for the year. Changes to production expectations at Kazatomprom, Kazakhstan’s state uranium company, reverberate through the global market, given it accounts for roughly a quarter of world uranium mine output.

The price of bitcoin rallied into the widely anticipated Trump speech, but it was a “Sell The News” event, as BTC prices fell from $70k last weekend to below $60k this weekend.

Here’s what Trump promises he would do for the crypto industry if elected president.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.