Home › Market News › AI, CPI & TECHNOLOGY INVESTING MANIA

The Economic Calendar:

MONDAY: Used Car Prices (8:00a CT), Fed Bowman Speech (12:00p CT), Fed Kashkari Speech (12:50p CT), Consumer Credit Change (2:00p CT), Fed Bostic Speech (5:00p CT), Fed Musalem Speech (5:30p CT)

TUESDAY: NFIB Business Optimism Index (5:00a CT), Balance of Trade (7:30a CT), Redbook (7:55a CT), RCM/TIPP Economic Optimism Index (9:10a CT) Fed Bostic Speech (11:45a CT), 3-Year Note Auction (12:00p CT), Fed Collins Speech (3:00p CT), API Crude Oil Stock Change (3:30p CT), Fed Jefferson Speech (6:30p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Fed Logan Speech (8:15a CT), Wholesale Inventories (9:00a CT), EIA Petroleum Status Report (9:30a CT), Fed Barkin Speech (9:30a CT), Fed Goolsbee Speech (9:30a CT), Fed Logan Speech (9:45a CT), Fed Williams Speech (10:00a CT), Fed Barkin Speech (11:15a CT), Fed Jefferson Speech (11:30a CT), 10-Year Note Auction (12:00p CT), FOMC Minutes (1:00p CT), Fed Collins Speech (4:00p CT), Fed Daly Speech (5:00p CT

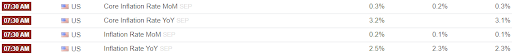

THURSDAY: Jobless Claims (7:30a CT), CPI (7:30a CT), Core Inflation Rate (7:30a CT), Fed Cook Speech (8:15a CT), EIA Natural Gas Report (9:30a CT), 30-Year Bond Auction (12:00p CT), Fed Balance Sheet (3:30

FRIDAY: PPI (7:30a CT), Fed Goolsbee Speech (8:45a CT), University of Michigan Consumer Sentiment (9:00a CT), WASDE Report (11:00a CT), Baker Hughes Rig Count (12:00p CT), Fed Bowman Speech (12:10p CT)

Key Events:

Our general expectation is that the CPI print will not be weak or strong enough to affect the size of the next Fed cut. However, we see signs of an uptick in specific components like food inflation.

Stocks surged on Friday following the release of the September jobs report, which showed robust job growth. However, this positive data also led to a complete reversal in expectations for a 50-basis point Fed rate cut next month.

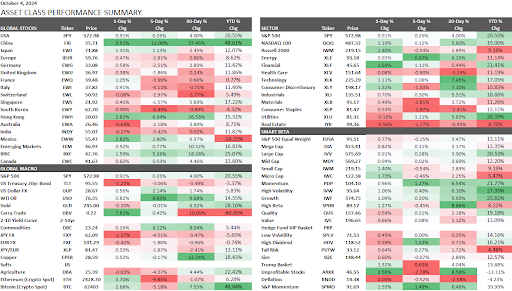

The S&P 500 ended the week slightly higher +0.26%, and the Nasdaq 100 added +0.12%.

Chinese stocks continued their impressive performance, gaining 11% last week and reaching a 40% increase over the past three weeks.

The market was closely watching two major events: the ongoing port strike and the missile attack on Israel by Iran.

Good news – the port strike began on October 1st and was resolved quickly in three days. The bad news is that it only took a 62% wage increase.

Excerpt from Bill Nygren, Portfolio Manager at Oakmark Funds shareholder letter:

“There have been two technologies in my career that seem similar to the artificial intelligence (AI) excitement boosting tech stocks today – computers and the Internet. When I was in business school in 1980, there was so much market interest in the computer manufacturers that IBM was the largest market cap company, and the industry was referred to as “IBM and the Seven Dwarfs” (Burroughs, UNIVAC, NCR, Control Data, Honeywell, General Electric and RCA). Suffice it to say that profits from computer manufacturing disappointed all eight companies.

Then in 2000, amidst “dotcom” hysteria, the largest cap Internet companies were Cisco, America Online (AOL), and Yahoo! AOL and Yahoo! ended up nearly worthless, and Cisco, at a lower share price than in 2000, has lost 80% relative to the S&P 500.

We think these results should give pause to anyone believing the AI winners have already been determined.”

We are watching CLX2024, the news headlines, and any new developments.

The recent missile attack on Israel by Iranian-backed forces has heightened tensions in the Middle East, driving up oil prices. OPEC has dismissed reports of a Saudi minister warning about potential oil prices as low as $50 per barrel.

The ongoing conflict raises concerns about further escalation and potential Israeli retaliation. The White House has described the missile attack as a “significant escalation,” and Israel has suffered a separate terrorist attack that resulted in casualties.

These geopolitical tensions have created a bullish environment for crude oil. However, it’s important to note that the global demand for oil remains weak due to economic challenges in China, Europe, and the United States.

A direct war between Israel and Iran could significantly disrupt Iranian crude and refined products exports, leading to further upward pressure on oil prices.

In light of last week’s stronger-than-expected labor market data, traders have significantly reduced their expectations for a larger rate cut in November. Futures trading now indicates a 97% odds of a 25-basis point cut at the November meeting.

Wall Street’s projection for total rate cuts before the end of the year has also been revised downward from 75 basis points to 50 basis points.

Japanese yen futures have experienced a sharp decline, breaking through key support levels. This downward trend is primarily driven by dovish statements from Prime Minister Shigeru Ishiba and Bank of Japan policymakers, which have reduced expectations for a near-term interest rate hike.

The yen carry trade, a strategy involving borrowing in yen to invest in higher-yielding currencies, has gained momentum as traders anticipate further yen weakness.

Key policymakers, including Prime Minister Ishiba, Bank of Japan Governor Kazuo Ueda, and BOJ member Asahi Noguchi, have expressed concerns about the global economy and the potential for deflation, leading to a more cautious stance on interest rates.

In response to the dovish outlook, the yen has weakened significantly against the U.S. dollar. However, Japanese stocks have seen gains.

With the U.S. elections just 29 days away, various models and indicators are being used to predict the election outcome.

One such model, Allan Lichtman’s “13 Keys,” has a proven track record of accurately predicting presidential elections. However, it’s essential to consider that this model is not solely reliant on the stock market.

While the stock market can influence consumer confidence and spending through the wealth effect, it’s just one of many factors that contribute to the overall economic climate. Nate Silver of FiveThirtyEight has challenged several of Lichtman’s 13 keys, suggesting they may favor Trump.

It’s crucial to remember that the stock market is not a definitive predictor of election outcomes. While it can provide insights into economic sentiment, it’s essential to consider a broader range of factors when making predictions.