Home › Market News › What Are The Markets Telling Us About The Upcoming Presidential Election?

The Economic Calendar:

MONDAY: Fed Logan Speech (7:55a CT), CB Leading Index (9:00a CT), Fed Kashkari Speech (12:00p CT), Fed Schmid Speech (4:05p CT)

TUESDAY: Redbook (7:55a CT), Fed Harker Speech (9:00a CT), Richmond Fed Manufacturing Index (9:00a CT), Money Supply (12:00p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Fed Bowman Speech (8:00a CT), Existing Home Sales (9:00a CT), EIA Petroleum Status Report (9:30a CT), Fed Barkin Speech (11:00a CT), 20-Year Bond Auction (12:00p CT), Fed Beige Book (1:00p CT)

THURSDAY: Building Permits (7:00a CT), Chicago Fed National Activity Index (7:30a CT), Jobless Claims (7:30a CT), Fed Hammack Speech (8:45a CT), S&P Global Composite PMI Flash (8:45a CT), New Home Sales (9:00a CT), EIA Natural Gas Report (9:30a CT), Kansas Fed Manufacturing Index (10:00a CT), Fed Balance Sheet (3:30a CT)

FRIDAY: Durable Goods (7:30a CT), University of Michigan Consumer Sentiment (9:00a CT), Baker Hughes Rig Count (12:00p CT)

Key Events:

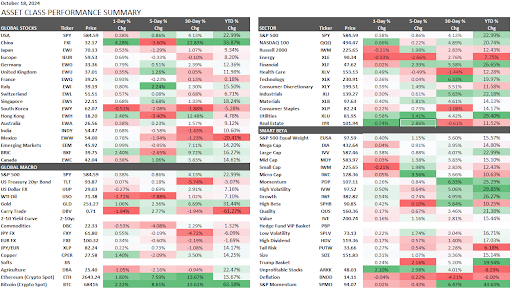

There are twelve (12) trading sessions until the presidential election, and there’s an observable market movement towards what’s being called the “Trump trade” – expectations of policy changes that could include tariff hikes, substantial deregulation, and increased fiscal spending.

Takeaways:

Source: Polymarkets

There are only 50 trading days left in this wild year and just 12 trading sessions until the presidential election. Get ready for a whirlwind of headline news and market volatility!

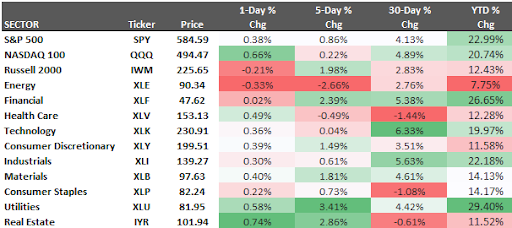

The S&P 500 (ES) and Nasdaq 100 (NQ) have been on a steady climb, with the ES hitting its 48th new high for the year.

The S&P 500 is up by 23% for 2024.

Are we getting a little ahead of ourselves? Probably. But hey, who cares? With all the endless stimulus and the upcoming election, it’s like the market is on a Jake and Logan Paul “Prime” caffeine buzz.

So, buckle up, folks. The next few weeks are going to be a wild ride. Just remember, even if the market seems overextended, it will probably keep going up anyway. It’s 2024, and anything is possible!

Traders are increasingly fixated on worst-case scenarios (puts), focusing on downside risks and potential market crashes.

Despite this bearish sentiment, the S&P 500 has steadily risen and is approaching the 6000 level. There is a possibility of a “mega option gamma” event at this level, as dealers may be forced to buy calls to hedge their positions.

This potential for a gamma squeeze could further fuel upward momentum in the market, leading to a breakout beyond the 6000 level.

Recent customer activity, such as the purchase of large quantities of call spreads above the 6000 strike and 20,000 January SPX 9000 calls, indicates a belief in the market’s potential for significant upside.

What we are watching going into year-end:

~Election.

~The Fed.

~Israel/Iran conflict.

~Possible end to Ukraine/Russia war.

~China stock market and economic stimulus.

~Bitcoin reaction to $70k

~Any uptick in inflation.

~Tax selling in beaten-up names.

~Oil prices.

~Earnings

Earnings are the drivers in stocks for the next quarter and a key indicator as to whether the market is in a healthy environment.

Last week, the European Central Bank cut its key interest rate to 3.25%, the third quarter-percentage-point reduction of the year.

Money markets imply an 18% chance of a half-point cut at the final meeting of the year and are now almost fully priced for quarter-point reductions at every ECB meeting through April.

It feels like $70k Bitcoin is around the corner. The march of Bitcoin towards the $70,000 mark reflects a combination of market dynamics, investor sentiment, and regulatory developments as of late 2024.

Despite the bullish outlook, there’s acknowledgment of tight liquidity conditions and the need for sustained buying interest. The market’s behavior around key levels like $70,000 was seen as critical, with some analysts cautioning that a failure to break through could lead to a shift in short-term trends.

Source: Tradingview

WTI crude oil futures are at the bottom of the range as the “war premium” has been discounted, and worries of a Trump victory speculate more supply.

The Iranian oil industry has faced a series of setbacks in recent weeks, coinciding with heightened tensions in the region.

Following reports of assurances from Israeli Prime Minister Benjamin Netanyahu regarding Iranian nuclear and oil sites, Iran’s oil infrastructure has experienced several incidents. An oil spill occurred near Kharg Island, one of Iran’s main oil export terminals, and a fire broke out at a refinery in Khuzestan province.

These incidents raise concerns about the potential impact on Iran’s oil production and exports. While the exact causes of these events remain unclear, they highlight the vulnerability of Iranian oil infrastructure to disruptions.

Source: Tradingview

Gold futures have reached record highs!

Gold futures prices have surpassed previous records, with prices hitting $2,733.90 an ounce, which is noted as a new intraday record high.

The surge in gold prices can be attributed to various factors, including geopolitical uncertainty, expectations of lower interest rates by the Federal Reserve, and significant buying from central banks globally, especially from China. These conditions have led traders to seek gold as a safe-haven asset.

Quick Overview:

Overall, the soft commodity market has been influenced by a combination of factors, including supply and demand dynamics, economic conditions, and geopolitical events.