Home › Market News › Fed Meeting, Bond Auctions, and the Presidential Election

The Economic Calendar:

MONDAY: Factory Orders (9:00a CT), Total Vehicle Sales (9:00a CT), 3-Year Note Auction (12:00p CT)

TUESDAY: Balance of Trade (7:30a CT), Redbook (7:55a CT), S&P Global Composite PMI (8:45a CT), ISM Services Index (9:00a CT), 10-Year Note Auction (12:00p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), EIA Petroleum Status Report (9:30a CT), 30-Year Bond Auction (12:00p CT)

THURSDAY: Jobless Claims (7:30a CT), Used Car Prices (8:00a CT), Retail Inventories (9:00a CT), Wholesale Inventories (9:00a CT), EIA Natural Gas Report (9:30a CT), Fed Interest Rate Decision (1:00p CT), Fed Press Conference (1:30p CT)

FRIDAY: University of Michigan Consumer Sentiment (9:00a CT), Fed Bowman Speech (10:00a CT), Baker Hughes Rig Count (12:00p CT)

Key Events:

FOMC decision on Thursday, as markets predict a 25 basis point cut in the Fed Funds Rate.

Since the Federal Reserve’s aggressive half-point rate cut in September, economic indicators have painted a mixed picture. While the labor market has shown signs of weakening, overall economic activity has remained relatively resilient. However, inflation concerns persist, with some indicators suggesting that price pressures may not have fully subsided.

Are U.S. bond yields going to start to matter to the stock market? As of this writing, the 10-year is printing a 4.35% yield, trading at the highest levels since early July. Drawing trend lines is not an exact “science,” but the entire 4.3%/4.35% area is huge.

Source: CME Fedwatch

All eyes turn to the results of the election, with hopeful results a few days from today.

The stock market is increasingly concentrated in a handful of mega-cap stocks. The top 10 stocks now account for a record-high 37% of the S&P 500.

Traders are closely monitoring soaring bond yields, particularly the 10-year Treasury yield. A significant increase in yields could lead to increased market volatility and potential downside for equities. If we get the right setup, we will play it with ES or SPY December put spreads.

Corporate buyback executions are back with $6B worth of demand per day during November.

While there’s been recent selling pressure, particularly in the tech sector, large institutional investors like long-only funds have been relatively muted in their selling activity. This suggests that the recent market weakness may be driven by short-term factors rather than a fundamental shift in sentiment.

Seasonality starts to kick in materially from here, as November is the second-best-performing month in the last ten years.

Source: Refinitiv

Despite robust economic data and a potential for a smooth transition of power, the market is pricing in increased volatility.

The VIX index is trading above 22, a measure of market volatility, has risen above recent averages, indicating growing uncertainty. SPX put skew is trading at the highest levels we’ve seen all year and almost as steep as the skew we experienced during the regional banking crisis of early 2023.

This increased volatility has created opportunities for traders to profit from options strategies, such as buying put spreads and put ratios on the S&P 500 as a hedge pre election.

A significant news event occurred just minutes after the 1:30pm CST close of trading in WTI, potentially impacting the outcome for many oil options traders. A headline emerged suggesting that “Iran was preparing a major retaliatory strike against Israel.”

Oil prices then rallied sharply, filling a gap that had formed during the trading session. Unfortunately, the news release’s timing was too late to benefit options traders who had purchased 6950 or 7000 call options expiring that day. Those calls ended up expiring worthless.

Was the timing of the headline release was just a coincidence. The incident highlights the importance of timely information and market volatility in the energy sector. Geopolitical tensions and unexpected events can have a substantial impact on oil prices, creating both opportunities and risks for traders.

Source: TradingView

Oil prices rallied sharply after Iran threatened retaliation against Israel for a recent attack. This development heightened concerns about potential disruptions to Middle Eastern oil supplies, driving prices higher.

Early in the week, the perception that after the Israeli attack that Iran’s oil infrastructure was going to be safe forever was shattered. Putting the war risk back into the trade.

Now Israel says it is at ‘high level of readiness’ for Iranian attack. Is real has already signaled that if Iran ever attacked Israel again the targets that were previously not attacked would be fair game in other words there is a high likelihood that if Iran is foolish enough to carry out this attack that Israel will take out its nuclear facilities as well as its oil production and export capabilities.

The potential for a larger conflict in the Middle East, involving Iran and Israel, could have significant implications for global oil supplies and prices. Investors will be closely monitoring developments in the region and assessing the potential impact on the energy market.

Gold futures experienced a small weekly decline after its record-breaking rally paused. All eyes are on next week’s US elections—a major risk event that had recently driven prices higher despite rising headwinds from robust US economic data and increasing yields, which could reduce the pace and depth of future rate cuts.

Depending on the election outcome, we see the risk of a 100+ correction next week, especially if the results prevent one party from gaining control of the White House and Congress. This event is likely to heighten concerns over excessive government spending, potentially pushing the debt-to-GDP ratio higher while fuelling inflation fears.

Traders have adjusted positions in anticipation of the U.S. elections on November 5—a pivotal event that introduces considerable binary risks due to the high uncertainty surrounding the outcome.

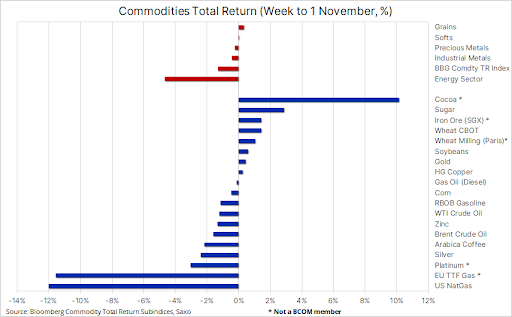

The Bloomberg Commodity Total Return Index, preferred for its diversified energy, metals, and agriculture exposure, remains up by roughly 5% year-to-date. Gains in precious metals, soft commodities, and industrial metals have offset declines in grains and energy, with the latter dragged down primarily by a steep 41% drop in natural gas.

Continued weakness in natural gas prices amid warmer weather forecasts in the US and Europe, indicating sluggish demand for heating fuels.

Hedge funds have for now adopted a sell-into-rally strategy in Nat Gas.

It’s all about the election in Bitcoin futures this week. Our thoughts:

1. If a Trump victory, we use options breakevens to imply a price rise of about 4% when the presidential outcome is known, with an upside move of around 10% within the week.

2. If the Republicans sweep Congress, our year-end target level of BTC is over 100,000(USD).

3. If Harris wins, we see BTC initially trading lower but still ending 2024 at fresh highs around 75,000(USD).