Top things to watch this week

The Economic Calendar:

MONDAY: Chicago Fed National Activity Index (7:30a CT), Consumer Confidence (7:30a CT), 2-Year Note Auction (7:30a CT)

TUESDAY: Building Permits (7:00a CT), Durable Goods (7:30a CT), Redbook (7:55a CT), New Home Sales (9:00a CT), Richmond Fed Manufacturing Index (9:00a CT), Money Supply (10:00a CT), 5-Year Note Auction (10:30a CT)

WEDNESDAY: MARKETS CLOSED FOR THE CHRISTMAS HOLIDAY

THURSDAY: Jobless Claims (7:30a CT), EIS Petroleum Status Report (10:00a CT), 7-Year Note Auction (12:00p CT), Fed Balance Sheet (3:30p CT)

FRIDAY: Good Trade Balance (7:30a CT), Retail Inventories (7:30a CT), Wholesale Inventories (7:30a CT), S&P Case-Shiller Home Price Index (8:00a CT), EIA Natural Gas Report (9:30a CT), Baker Hughes Rig Count (12:00p CT)

Key Events:

- It is the Christmas holiday week, so expect light volume and a lack of liquidity.

- Lite economic data with Durable Goods on Tuesday.

- Stock tax loss selling on beaten-up names is approaching the final days.

- Picking stock sectors for rotation inflows into the new year.

- U.K GDP (growth) on Monday.

- BoJ and BoC central bank minutes on monetary policy.

- Watching trades in VIX, Gold futures, Value vs Growth, Tax-loss selling names

U.S. INTEREST RATE FUTURES

Future rate cuts on hold, and the odds of only one cut in 2025.

Last Wednesday, the Federal Reserve cut the Fed Funds target rate by 25 basis points. While traders expected the cut in rates, they were surprised by a more hawkish tone in their forecasts for future rate moves than anticipated. The central bank lowered its projected number of rate cuts for 2025, signaling a potential pause in easing monetary policy.

This shift in the Fed’s stance initially caused a stock market sell-off, but the market recovered most of its losses Friday.

“I think we’re in a good place, but I think from here it’s a new phase, and we’re going to be cautious about further cuts,” Fed Chair Jay Powell declared. “We have lowered our policy rate by a full percentage point from its peak, and our policy stance is now significantly less restrictive.”

Rate traders are now concerned about the potential for higher interest rates and a tighter monetary policy environment. Additionally, concerns about the impact of potential trade tensions and geopolitical risks have further weighed on market sentiment.

Source: TradingView

RATES AND FX THEMES WE ARE WATCHING

- Bessent (possible Fed chair) not being much of a dovish development,

- There was a regime change last week (Fed on hold),

- Trump being inflationary/reflationary,

- Higher inflation seasonality in Q1,

- The tendency for fixed income to sell off in Q1, and

- Inflation will stall before the Fed’s 2% target, so they will have to stop easing once the target rate reaches 4-4.5%.

- Bond vigilantes suddenly waking up,

- Countries selling US fixed-income holdings ahead of tariffs or other Trump punitive policies.

STOCK INDEX FUTURES

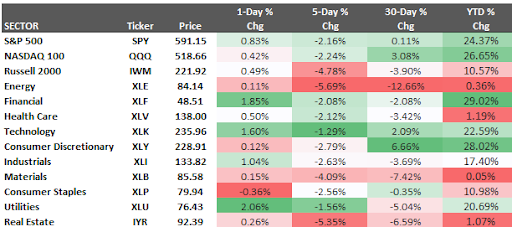

For the week, the S&P 500 was down -2.16% and the Nasdaq 100 was lower by -2.24%

Here are Santa’s notes going into the end of the year…

S&P 500 and Nasdaq 100 Futures Review:

- Market Dynamics: The week began with a significant sell-off, which might have been fueled by profit-taking after an impressive rally. Fed Chair Powell’s comments temper the holiday cheer, potentially dousing the Wall Street Santa rally. Despite this, the underlying economic indicators remain strong, suggesting that rates are still on a downward trajectory.

- Performance and Projections: The S&P 500 futures, symbol ES1, experienced volatility but showed resilience. Given the recent pessimism, a conservative target for this week could be set above 6120, reflecting the market’s strong support. The market is buoyed by continued buybacks into year-end, although there’s still room for investors to add positions, particularly in the “Magnificent Seven” (Mag7) names.

- Sector Analysis: Cyclicals have received solid inflows driven by robust economic data and consumer spending resilience. On the flip side, the Healthcare and Energy sectors are lagging, indicative of defensive underperformance. This positioning suggests the potential for these sectors to benefit from any sector rotation in 2025.

- Valuation Concerns: While the market remains well-supported, valuations, especially in tech, are a concern. This is something to keep an eye on moving into the new year.

- Tech Leadership: The Nasdaq 100 continues to be led by technology stocks, which have been the primary drivers of the market’s gains. Despite the recent dip in momentum factors, the sentiment around tech remains positive, with many viewing the current dip as a buying opportunity into year-end.

- Market Sentiment: The extreme sell-off at the beginning of the week likely caught many investors off-guard, but the fundamentals supporting tech and growth stocks are still in place. The Nasdaq 100 futures could see further gains if the current trend of buybacks and CTA (Commodity Trading Advisor) investments continues.

- Year-End Positioning: With only a few weeks left in the year, there’s little incentive for a significant sell-off, repositioning, or rotation. The Nasdaq 100 futures are expected to maintain their upward trajectory unless there’s an important shift in economic indicators or policy expectations.

U.S. GOVERNMENT SHUTDOWN AVERTED (FOR NOW)

Just as the government funding deadline loomed like a dark cloud over a Saturday morning cartoon marathon, Congress, in a true last-minute scramble, passed an interim plan to dodge the dreaded shutdown after what can only be described as a legislative circus in Washington.

This spending band-aid comes just a month before President-elect Trump returns to the White House, armed with an ambitious agenda that might be harder to push through budget items. The “orange elephant” will wait at the door for the next Congressional session.

In the witching hours, while most of us were dreaming of sugarplums or wondering if we remembered to turn off the coffee maker, the Senate decided to play Santa Claus. They approved a boost in Social Security benefits for 2 million retired public servants, because nothing says “Happy Holidays” like a little extra cash for the golden years.

So, with government operations funded until March 14, we can all breathe a sigh of relief, knowing our national parks won’t turn into ghost towns… at least for now.

GLOBAL INTEREST RATES AND FX

Central Bank Updates: A Mixed Bag of Hawkish and Dovish Tones.

Santa’s notes below:

U.S. Fed:

- Rate Cut: As expected, the Fed delivered a 25 basis point rate cut, bringing the target range to 4.25-4.50%.

- Hawkish Tilt: The Fed’s updated economic projections indicate a more hawkish stance, with higher interest rate forecasts for 2025 and 2026.

- Cautious Approach: The Fed emphasized the need for a cautious approach to further rate cuts, citing concerns about potential inflationary pressures.

Bank of Japan:

- Rate Hold: The BoJ maintained its ultra-loose monetary policy, keeping the interest rate at -0.25%.

- Cautious Stance: The central bank reiterated its cautious stance, highlighting the need to observe economic data more closely.

- Potential for Future Tightening: While the BoJ remains dovish, future rate hikes are possible, particularly if inflationary pressures intensify.

Bank of England:

- Rate Hold: The Bank of England held interest rates steady at 4.75%.

- Diverging Views: The MPC members were divided on the appropriate policy stance, with some advocating for further rate cuts.

- Cautious Outlook: The Bank of England maintained a cautious outlook, citing concerns about economic growth and inflation.

European Central Bank (ECB):

- Rate Cut: The ECB cut interest rates for the third time, signaling a more dovish stance.

- Removed Restrictive Language: Removing “sufficiently restrictive” language from the ECB’s statement indicates a shift towards a more accommodative policy.

China:

- Stimulus Measures: China announced plans to stimulate its economy through fiscal measures and potential interest rate cuts.

- Economic Challenges: The country continues to grapple with weak consumer confidence, deflationary pressures, and a struggling housing market.

BITCOIN FUTURES

Bitcoin experienced a significant but expected drawdown, falling from a peak of $108,000 to around $93,000 before stabilizing at approximately $97,400 as of this writing. This drop, roughly 15%, has caused some alarm, especially given the public expectation for Bitcoin to continue its upward trajectory through the year’s end.

However, this correction should be considered in context. Earlier this year, Bitcoin saw a similar 15% drop from $72,000 to $61,000, which is relatively minor compared to historical bull market drawdowns.

Alex Thorn from Galaxy Research noted that the last two bull markets saw numerous drawdowns of over 12%, suggesting that these corrections are part of Bitcoin’s volatile nature during strong upward trends.

Federal Reserve Chair Jerome Powell clarified that the Fed has no authority to hold Bitcoin, squashing speculation about a strategic Bitcoin reserve under potential policy changes by President-elect Trump. Despite this, the market remains buoyed by Trump’s crypto-friendly policies and the recent resignation of SEC chair Gary Gensler.

Source: Galaxy

CRUDE OIL FUTURES

Crude Oil futures have struggled despite record global demand, primarily due to slowing economic indicators in China. The oil price rally was halted after China reported disappointing retail sales growth for November, with an increase of only 3% year over year, significantly lower than October’s 4.8%.

The market’s momentum, which saw it close above key technical levels like the 20-day and 50-day moving averages on Friday, has now turned to potential Chinese stimulus packages. However, the market’s trajectory could falter if China does not announce a substantial economic support plan soon.

The growing risk of new sanctions on Russia and Iran, alongside a force majeure declaration in Libya, adds complexity. These elements could tighten supply. Meanwhile, Russian President Putin has hinted at tensions with the West, potentially signaling further geopolitical risks for oil markets.

With these factors at play, the oil market is at a pivotal point. It is closely watching China’s next move while navigating the geopolitical landscape that could influence supply dynamics.

Source: TradingView

asset class performance summary

All content published and distributed by Topstep LLC and its affiliates (collectively, the “Company”) should be treated as general information only. None of the information provided by the Company or contained herein is intended as (a) investment advice, (b) an offer or solicitation of an offer to buy or sell, or (c) a recommendation, endorsement, or sponsorship of any security, Company, or fund. Testimonials appearing on the Company’s websites may not be representative of other clients or customers and is not a guarantee of future performance or success. Use of the information contained on the Company’s websites is at your own risk and the Company, and its partners, representatives, agents, employees, and contractors assume no responsibility or liability for any use or misuse of such information.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the investor’s initial investment. Only risk capital—money that can be lost without jeopardizing one’s financial security or lifestyle—should be used for trading, and only those individuals with sufficient risk capital should consider trading. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results.

CFTC Rule 4.41 – Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.