Top things to watch this week

The Economic Calendar:

MONDAY: Martin Luther King Jr. Holiday – Early Close for CME Group Markets

TUESDAY: 52-Week Bill Auction (12:00p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Redbook (7:55a CT), 20-Year Bond Auction (12:00p CT)

THURSDAY: Jobless Claims (7:30a CT), EIA Natural Gas Report (9:30a CT), EIA Petroleum Status Report (10:00a CT), Fed Balance Sheet (3:30p CT)

FRIDAY: Building Permits S&P Global Composite PMI (8:45a CT), Existing Home Sales (9:00a CT), University of Michigan Consumer Sentiment (9:00a CT), Kansas Fed Manufacturing Index (10:00a CT), Baker Hughes Rig Count (12:00p CT)

Key Events:

- A holiday-shortened trading week with MLK holiday and President Trump’s inauguration.

- Traders are watching as the S&P 500 nears record highs.

- Traders are watching the executive orders announced in the first days and weeks of the new administration. Pay close attention to the inflationary impact of executive orders.

- Lite economic report week with Existing Home Sales and 20-year bond auction results.

- Earnings season is busy with reports from Alcoa, Netflix, Procter & Gamble, Johnson & Johnson, American Express, and Verizon.

- Looking ahead to the FOMC interest rate decision on January 29.

PRESIDENTIAL INAUGURATION

- Currency Markets: The dollar might stay in a holding pattern, retaining its overvaluation against tariff-sensitive currencies. This cautious stance is attributed to anticipating policy announcements that could impact global trade and economic relations.

- Stock Markets: Traders are likely preparing for potential policy shifts, which could affect various sectors differently. There’s particular attention on how new administration policies might influence sectors like technology, manufacturing, and finance due to possible trade, regulation, and fiscal policy changes. The market might experience increased volatility as these policies unfold or are hinted at during the inauguration speeches or immediately thereafter.

- Bond Markets: Bond yields could see movements based on the perceived direction of fiscal policy, with potential impacts on inflation expectations and monetary policy adjustments by the Federal Reserve. If new policies suggest higher inflation or changes in interest rate expectations, this could pressure bond prices.

- Crypto Markets: While some analysts believe the event is primarily priced in, there’s still speculation about how executive actions could sway crypto markets, particularly if they touch on regulation or economic policies that indirectly affect digital assets.

EQUITY INDEX FUTURES

After a rocky start to the new year, the bulls roared back over the past few days.

The stock market experienced a rally driven by a slight slowdown in core inflation, providing some relief for bullish traders. This positive reaction highlights the market’s sensitivity to any signs of easing inflationary pressures.

However, core inflation remains significantly above the Fed’s 2% target, and the impact of specific policies, particularly those related to trade, could potentially lead to a resurgence of inflationary pressures.

Despite these concerns, asset prices have responded positively to the recent economic data.

Upbeat earnings results from major banks, including JPMorgan Chase, Wells Fargo, Goldman Sachs, BlackRock, and Citigroup, have further boosted market sentiment. While the official earnings season begins this week, these strong bank earnings have provided an encouraging start to the reporting period.

The Energy, Financial, Industrial, and Materials sectors are the YTD outperformers.

Technology and Consumer Staples have underperformed.

CRUDE OIL FUTURES

The recent surge in oil prices, pushing them above $80 per barrel, can be attributed to several factors:

- Tightening Oil Supplies: Global oil supplies have been tightening due to production cuts by OPEC+ and ongoing geopolitical tensions.

- Easing Inflation Under Control: The recent easing of inflation has boosted investor sentiment and increased risk appetite, leading to a stronger demand for oil.

- Sanctions on Russia: The toughening of sanctions against Russia, including the recent seizure of a tanker allegedly involved in evading oil sanctions, has further tightened global oil supplies.

Source: TradingView

JAPANESE YEN FUTURES

The dollar fell back and the Japanese Yen futures rallied, as speculation about another Bank of Japan interest rate rise builds.

Source: TradingView

INTEREST RATE FUTURES

The recent release of the Consumer Price Index (CPI) data has significantly impacted market expectations for Federal Reserve policy.

While headline inflation slightly increased, the core CPI reading, which excludes volatile food and energy prices, offered some relief, ticking down slightly. This modest slowdown in core inflation initially encouraged market optimism, with traders increasing bets on further rate cuts.

However, the market’s reaction was short-lived. The 10-year Treasury yield experienced a sharp decline to 4.62%, indicating a shift in investor sentiment towards a more hawkish Fed outlook. We are trading 1.5bp below the 20-day SMA (4.634%), and the 50-day SMA is down at 4.43%.

The market is now pricing in a lower probability of rate cuts in the near term, with expectations for a cut at the upcoming January FOMC meeting significantly reduced.

Despite this recent shift, the possibility of future rate cuts remains, particularly later in the year. The Fed’s stance will continue to evolve based on incoming economic data.

COPPER FUTURES

The recent surge in copper prices can be attributed to several factors:

- Softer-than-expected CPI: While inflation remains above the Fed’s target, the recent CPI report, which came in slightly below expectations, provided a short-term boost to copper prices.

- Supply Squeeze Concerns: Concerns over potential disruptions to copper supply chains, mainly due to the threat of U.S. tariffs on metal imports, have been a significant driver of the recent price increase. The New York futures market premium over the London cash market reflects this concern.

- Strong Chinese Demand: China’s plans to ramp up spending on its power grid, driven by the expansion of renewable energy sources, are expected to significantly increase demand for copper and other metals.

- Production Challenges: Production challenges faced by major mining companies, such as Rio Tinto’s lower iron ore shipments, have also contributed to tightening supply conditions in the market.

Source: TradingView

SURPRISES / RISKS

Evercore/ISI outlines some key risks we could see in 2025 and how we should consider structuring trades.

BITCOIN FUTURES

Traders anxiously await President Trump and his team’s actions on the crypto markets in the coming week. Most are cautiously optimistic.

We anticipate disclosing something about the Strategic Bitcoin Reserves (SBRs). We speculate that state entities will begin to accumulate BTC this year. Much of the initial buying will be done discretely.

Fidelity says to avoid stoking the asset’s reflexivity and preserve good entries. With this in mind, advocacy for smaller-scale SBRs has already begun: the Satoshi Action Fund says that as many as 20 different US states could introduce legislation establishing SBRs by this summer.

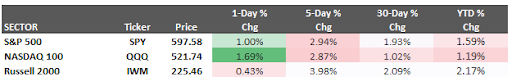

asset class performance summary

All content published and distributed by Topstep LLC and its affiliates (collectively, the “Company”) should be treated as general information only. None of the information provided by the Company or contained herein is intended as (a) investment advice, (b) an offer or solicitation of an offer to buy or sell, or (c) a recommendation, endorsement, or sponsorship of any security, Company, or fund. Testimonials appearing on the Company’s websites may not be representative of other clients or customers and is not a guarantee of future performance or success. Use of the information contained on the Company’s websites is at your own risk and the Company, and its partners, representatives, agents, employees, and contractors assume no responsibility or liability for any use or misuse of such information.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the investor’s initial investment. Only risk capital—money that can be lost without jeopardizing one’s financial security or lifestyle—should be used for trading, and only those individuals with sufficient risk capital should consider trading. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results.

CFTC Rule 4.41 – Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.