Home › Market News › Election Odds, Bitcoin, and This Weeks Economic Calendar

The Economic Calendar:

MONDAY: Used Car Prices (8:00a CT), Consumer Inflation Expectations (10:00a CT)

TUESDAY: NFIB Business Optimism Index (5:00a CT), Redbook (7:55a CT), Michael Barr Speaks (8:15a CT), Janet Yellen Testimony (9:00a CT), Jerome Powell Testimony (10:00a CT), 3-Year Note Auction (12:00p CT), Michelle Bowman Speaks (12:30p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Jerome Powell Speech (9:00a CT), Wholesale Inventories (9:00a CT), EIA Petroleum Status Report (9:30a CT), 10-Year Note Auction (12:00p CT), Austan Goolsbee Speaks (12:30p CT)

THURSDAY: Jobless Claims (7:30a CT), CPI (7:30a CT), EIA Natural Gas Report (9:30a CT), Raphael Bostic Speaks (10:30a CT), 30-Year Bond Auction (12:00p CT), Monthly Budget Statement (1:00p CT)

FRIDAY: PPI (7:30a CT), University of Michigan Consumer Sentiment (9:00a CT), WASDE Report (11:00a CT), Baker Hughes Rig Count (12:00p CT)

Key Events:

STOCK INDEX FUTURES

Fueled by optimism about a dovish Federal Reserve, U.S. equities notched fresh record highs last week. For the week, the S&P 500 was higher by 1.91%, and the Nasdaq-100 was up +3.56%.

Traders cheered signs of a softening labor market, interpreting them as a signal that inflation might be peaking. This, in turn, bolstered expectations of a 72% chance of a rate cut by the Fed in September.

The dovish sentiment followed a weaker-than-expected jobs report earlier in the week. This data and a low volatility index (VIX at 12.4) encouraged traders to take directional bets on the market, with some even positioning for both possibilities.

The U.S. labor market added 206,000 jobs, and the unemployment rate rose to 4.1%.

The tick higher to 4.1% unemployment rate gets the media talking about the so-called Sahm Rule—a formula developed by former Fed economist Claudia Sahm that suggests a half-point rise in the rolling three-month jobless rate average above the low of the prior year flags a recession.

Despite ongoing equivocation from Fed officials, markets are almost fully priced for two rate cuts this year. CME Group’s FedWatch tool currently indicates a 72% chance of the central bank cutting rates in September.

Some traders are saying, “The Fed wants to be dovish, but it can’t and might, in fact, need to raise rates.”

Source: CME Fedwatch

Oil prices are near a two-month high due to a potential drop in U.S. oil stockpiles, increased refinery activity for summer driving, and tensions in the Middle East.

Due to rising summer fuel demand, analysts predict a supply crunch in the coming months. UBS and JPMorgan forecast Brent crude, the global benchmark, to hit $90 per barrel this quarter.

The market is pricing a higher probability of a Trump win, and stocks keep rallying—or could they retrace on the back of profit-taking?

Since the debate, the betting markets have shown that Trump has a comfortable lead.

Mt. Gox, a defunct Bitcoin exchange, began repaying creditors with Bitcoin locked up for over a decade. This triggered concerns that the creditors might sell their Bitcoin, leading to a drop in the price.

On July 7, the Mt. Gox bankruptcy estate transferred 47,229 Bitcoin (valued at $2.6 billion) to a new address. This move is part of repaying creditors, as some of the Bitcoin was sent to a hot wallet of the Bitbank exchange.

This has raised concerns about a negative impact on BTC price since these coins, locked up for over a decade, could exert up to $4.5 billion in selling pressure. BTC’s price fell to as low as $53700 on July 5, but it has since recovered to $56800.

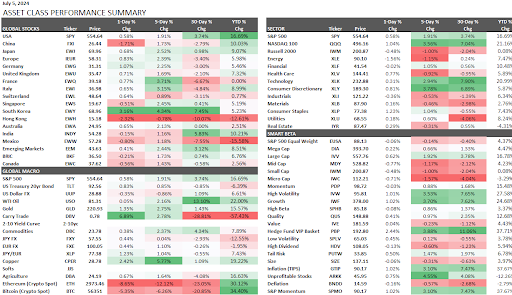

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.