Home › Market News › NATURAL GAS FUTURES BIG PICTURE

The Economic Calendar:

MONDAY: Building Permits (7:00a CT), New Home Sales (9:00a CT), Dallas Fed Manufacturing Index (9:30a CT), 5-Year Note Auction (12:00p CT)

TUESDAY: Durable Goods (7:30a CT), Redbook (7:55a CT), House Price Index (8:00a CT), Michael Barr Speaks (8:05a CT), Consumber Confidence (9:00a CT), Richmond Fed Manufacturing Index (9:00a CT), Dallas Fed Services Index (9:30a CT), 7-Year Note Auction (12:00p CT)

WEDNESDAY: MBA Morgage Applications (6:00a CST), GDP (7:30a CT), Consumer Spending (7:30a CT), Retail Inventories (7:30a CT), Wholesale Inventories (7:30a CT), EIA Petroleum Status Report (9:30a CT), Raphael Bostic Speaks (11:00a CT), Susan Collins Speaks (11:15a CT), John Williams Speaks (11:45a CT)

THURSDAY: Jobless Claims (7:30a CST), Personal Consumption Expenditures (7:30a CT), Chicago PMI (8:45a CT), Pending Home Sales (9:00a CT), EIA Natural Gas Report (9:30a CT), Raphael Bostic Speaks (9:50a CT), Austan Goolsbee Speaks (10:00a CT), Kansas Fed Manufacturing Index (10:00a CT), Loretta Mester Speaks (12:15p CT), John Williams Speaks (7:10p CT)

FRIDAY: PMI Manufacturing Final (8:45a CT), Construction Spending (9:00a CT), ISM Manufacturing Index (9:00a CT), University of Michigan Consumer Sentiment (9:00a CT), Christopher Waller Speaks (9:15a CT), Raphael Bostic Speaks 11:15a CT), Baker Hughes Rig Count (12:00p CT), Mary Daly Speaks (12:30p CT), Adriana Kugler Speaks (2:30p CT)

Key Events:

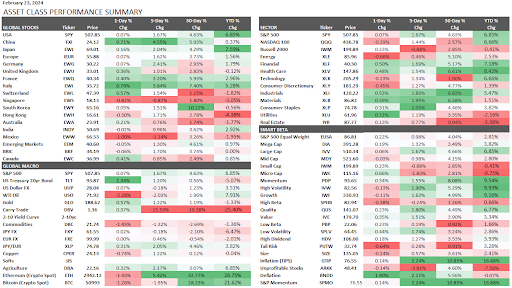

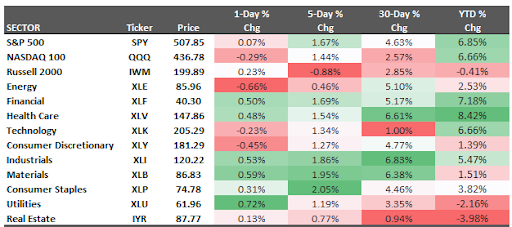

The S&P 500 closed at a new record high on Thursday, then was relatively flat on Friday. The S&P 500 was higher for the week by +1.67%, and the NASDAQ-100 was up +1.44%.

After a stellar 2023 for stocks, traders are getting more of the same in 2024. The S&P 500 and Nasdaq are both up roughly 7% YTD.

Some traders are optimistic because the current rally appears to be driven by strong earnings reports rather than expectations for interest-rate cuts.

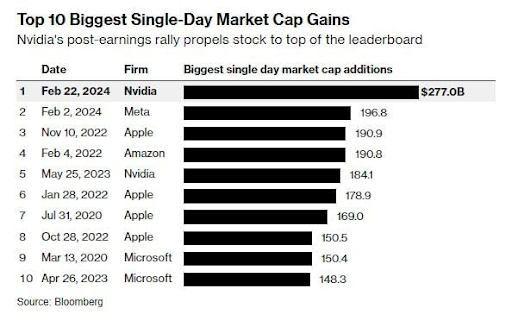

AI stocks were the story of the week. Nvidia’s market cap increased a record $277 billion in one trading day.

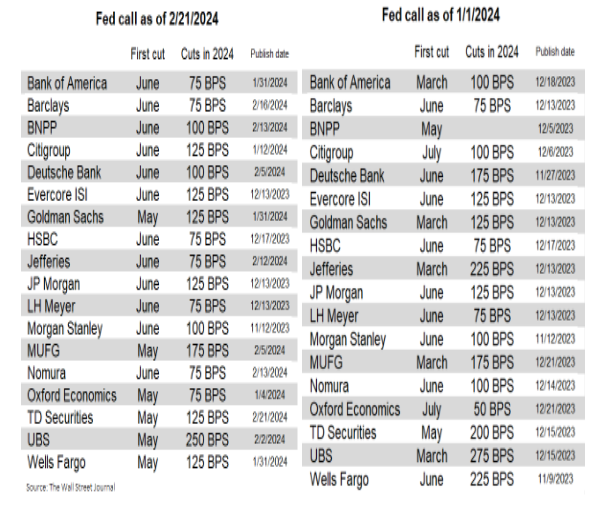

How does the Fed interest rate forecast compare to Wall Street economists?

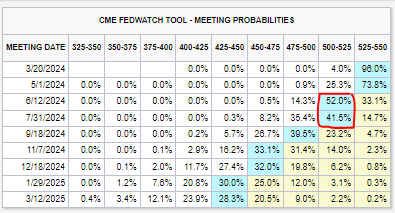

The Fed expects to make three rate cuts in 2024, and the major sell-side banks expectations are expecting more than three cuts (listed below).

Interestingly, the markets forecast the highest probability of the first-rate cut at the June FOMC meeting.

Source: SME Fedwatch

But there’s a wide dispersion of views about when the cuts begin (some in March, some in the summer) and how many cuts the central bank will deliver in 2024.

This informal running tally of sell-side banks and other Fed forecasters now sees June as more likely than May for the first cut.

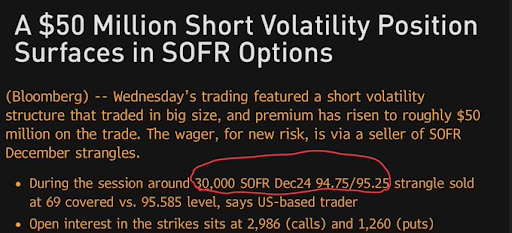

A large trader thinks rate changes will be on hold and is making a bet in SOFR Dec24 options. The $50 million short option volatility position trade structure is 30k SFRZ4 94.75/95.25 strangles sold at 69.

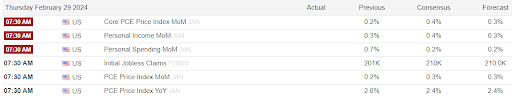

Buckle up for the Personal Consumption Expenditures (PCE) report on Thursday. The rate of PCE inflation is expected to pick up in January, with the consensus looking for +0.3% M/M (prev. +0.2%), while the core PCE print is expected +0.4% M/M (prev. +0.2%).

Traders are on high alert after CPI and PPI surprised to the upside in January.

Source: TradingEconomics

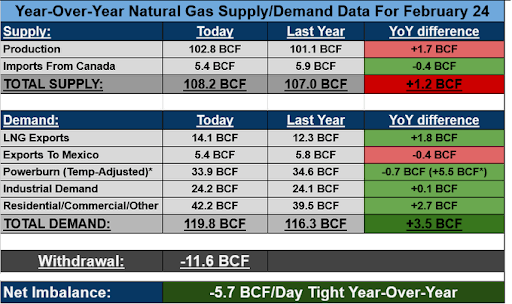

The natural gas futures market is currently characterized by significant volatility, influenced by weather conditions, supply levels, and strategic adjustments by key industry players. While recent trends indicate a downward pressure on prices, the strategic production cuts by major companies could potentially stabilize the market in the medium to long term. Investors and stakeholders are advised to closely monitor weather patterns, storage reports, and industry announcements, as these factors will continue to be pivotal in driving the natural gas futures market.

Ethereum surged past the $3,000 mark last Tuesday, its highest point since April 2022. As a trader, it’s crucial to note how blockchain applications have demonstrated remarkable adaptability across various networks, posing a challenge to Ethereum’s traditional first-mover advantage.

Traditionally, Ethereum’s dominance among smart contract networks has been attributed to its early entry into the market. Currently, Ethereum boasts a staggering 79% share of the combined market cap of major smart contract networks such as Solana, Cardano, Avalanche, and TRON.

Additionally, Ethereum hosts the lion’s share of the stablecoin market cap, with $69 billion worth of USDt and USDC compared to $51 billion on TRON and $3 billion on Solana.

As a trader, recognizing the shifting landscape of blockchain networks and their respective strengths is imperative for informed decision-making in the dynamic cryptocurrency market.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.