Home › Market News › Topstep Trading 101: The Wedge Formation

The purpose of this series is to educate newer traders on the basic principles and techniques of technical analysis. To a lot of you, this is old news, but for the rest of you, we are here to help you build a solid foundation for reading charts.

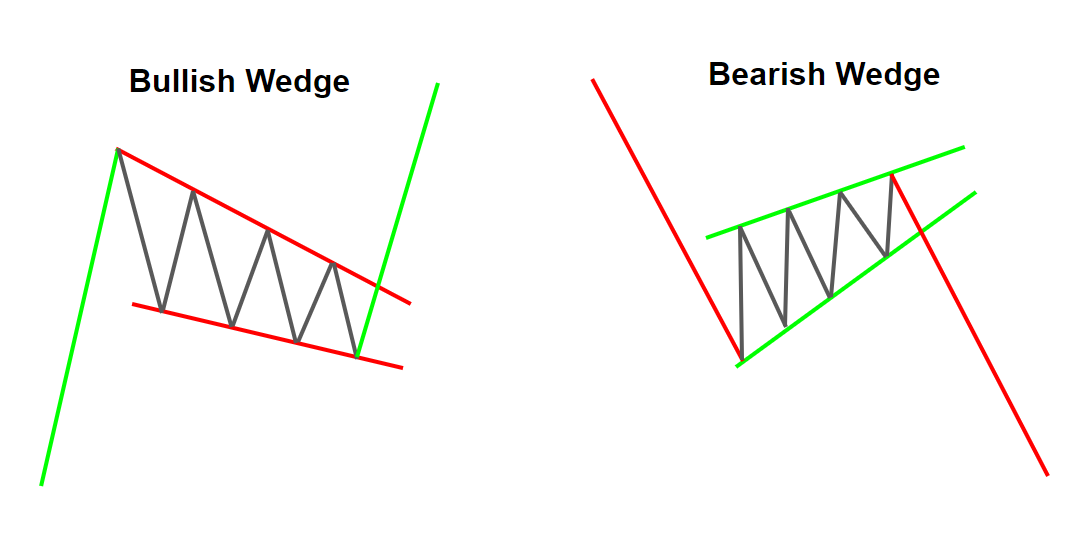

Another pattern you should be familiar with is the Wedge Formation. Compared to shorter time frame setups like flags and pennants, the wedge is more of an intermediate formation that develops over a period of up to 50 price bars. Wedges represent a pause in trend, and can be either bullish or bearish, depending on the prevailing trend.

While wedges are commonly known as continuation patterns, they are also known to signal trend reversals at major tops and bottoms. The reversal patterns are much larger than a typical continuation wedge, and take significantly longer to form, so for the sake of all you short term swing and day traders, we will focus on wedges as continuation patterns here.

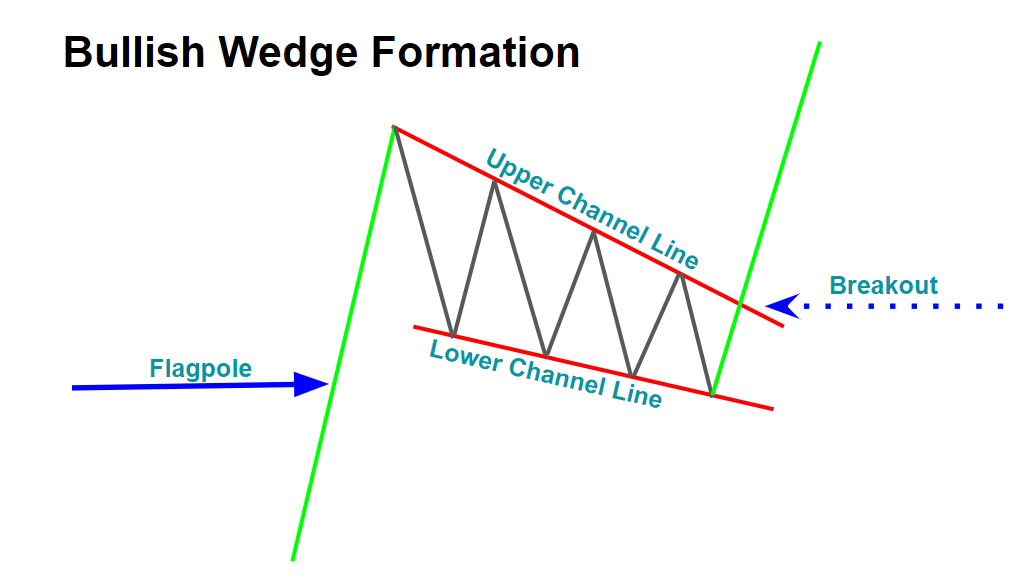

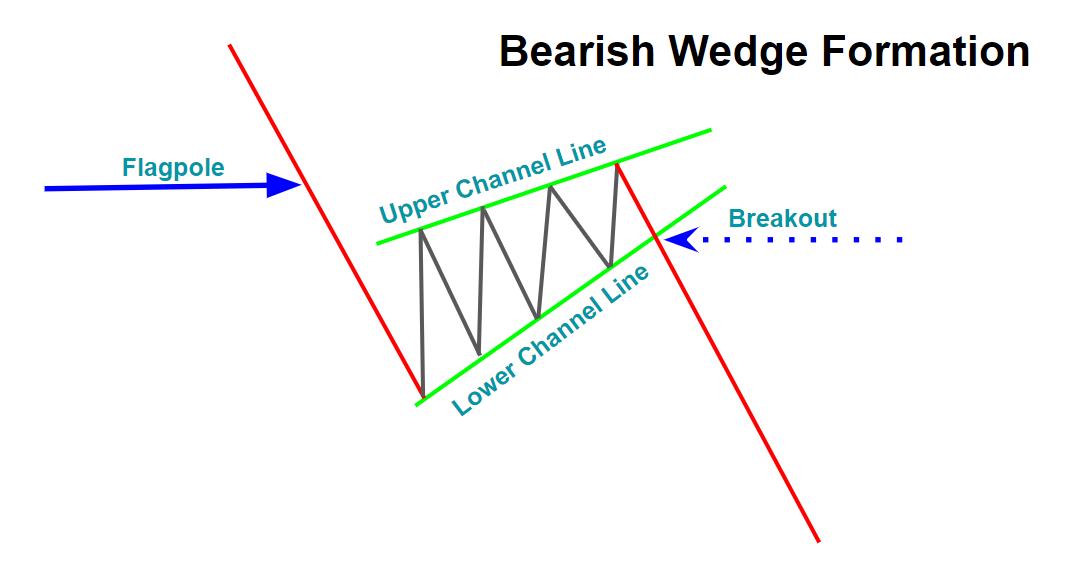

Wedges hold similar traits to both flag and symmetrical triangle patterns, in that they are drawn using 2 converging trendlines meeting at an apex. Price action will run counter to the prevailing trend, so a bullish wedge will slope down, and a bearish wedge will slope up. You should see a noticeable drop in volume as price moves toward the apex, followed by a sharp increase once a breakout is confirmed.

If price pulls back more than 50% of the prevailing trend move during the consolidation period, then the pattern is broken, and you should assume a change in trend is occurring.

Confirmation of a breakout is made when a price bar closes above the upper trendline in a bullish wedge, and below the bottom trendline in a bearish wedge.

The way this pattern is set up, it’s highly recommended to wait for a breakout before initiating a position. In a bullish continuation wedge, the two converging trendlines are pointing in the same direction, representing a series of lower highs and lower lows, so playing the breakout makes the most sense, at least from a risk management perspective. Since you are entering the market near the bottom of the formation, your risk parameters are tight, while profit targets are exponentially expanded.

Of course, more aggressive traders will still attempt to buy the lower trendline as the pattern progresses, and use new lows as stops and re-entry levels. However, the conservative method of waiting for confirmation will most likely yield higher profits in the long run.

The inverse is true when trading bearish wedge formations. Price will make a series of higher highs and higher lows as it moves towards the apex, and a position can be initiated when a breakout is confirmed with a price bar closing below the lower trendline.

A false breakout occurs when price moves above a resistance line or below a support line, and then quickly changes direction. These moves are known for trapping unsuspecting traders playing breakout levels on the wrong side, and then turning around to run their stops.

More times than not, a false breakout will signal that the pattern you are charting has failed to produce the expected follow through, and your expectations of the trade need to be re-evaluated.

Identifying a false breakout can be tricky, that’s why it’s so important to maintain discipline when it comes to risk management. The single easiest way to determine whether or not a breakout is true or false is to watch the volume patterns. As stated above, when price moves toward the apex of the wedge, you should begin to see a noticeable drop in volume, followed by a sharp increase as price breaks out of the formation.

The wedge formation is a low risk/high reward setup. Price and volume patterns need to align to confirm both the pattern and the breakout. If the formation takes too long to develop or if price moves too far away from the starting point, you may be witnessing a change in trend.

Trade Well!