Highlights

- The “cheapest prop firm” often comes with hidden costs like strict drawdowns, payout delays, and vague rules.

- Low entry fees can trap traders in Resets and lost profits, costing far more than the initial savings.

- Value matters more than price: clear rules, fair payouts, and strong platforms create real opportunities.

- Topstep offers transparent rules, weekly payouts up to $5K, and tools designed for trader discipline.

- With community support, coaching, and competitive pricing, Topstep provides the best long-term value for traders.

Introduction to prop firms

If you’ve ever searched “cheapest prop firm,” you’ve seen the same thing: firms racing to the bottom on price. $30 here, $50 there, maybe a promo that drops entry to lunch-money levels.

Now, think of a time you made a decision based only on price. More often than not, that “cheap” choice costs more than it saves, and prop firms are no different. Across the industry, subscriptions range from about $39 to nearly $600 a month, depending on account size and features. Those flash sales and bargain entry fees can blind you to the real cost.

Because here’s the truth: a low entry fee might look good, but if the rules, platforms, and payout policies aren’t in your favor, it can cost you far more in the long run. The real question isn’t what’s cheapest. It’s what are you actually buying?

What is a prop firm?

A prop firm, short for proprietary trading firm, gives traders a chance to earn an opportunity to trade the firm’s capital instead of their own. In a prop firm like Topstep, you pay for an evaluation (some prop firms call it a challenge) to prove your skills in a simulated environment. Pass, and you’re moved into a funded account where you can take payouts. At Topstep, you keep 90% of the profits while the firm covers the losses.

The value of prop firms goes beyond capital. You can trade across futures, forex, stocks, and commodities while building consistency in a structured setting. The best firms back traders with clear rules, fair profit splits, and built-in risk management to help you stay funded long enough to take profits.

For beginners, a prop firm offers a safe way to test strategies without draining your personal savings. For experienced traders, it’s a chance to scale up with meaningful buying power. And when a firm combines affordable evaluations with fast payouts and trader-friendly rules, you get more than just access to capital. You get a real shot at growing as a trader.

The hidden costs of cheap prop firms

When you go bargain hunting in prop trading, you’re not just paying for entry. You’re buying into a firm’s rules and restrictions. And that’s where things get tricky.

Here are some of the hidden costs traders run into with “cheaper” firms:

- Intraday Trailing Drawdowns: One wrong tick and your balance gets chopped, forcing you to trade scared and blow up your account. That entry fee “deal” suddenly cost you the $3,000 you should’ve been paid. (Learn more about why this is the number one rule that makes or breaks a payout.)

- Platform Limitations: Some firms lock you into clunky or outdated trading platforms. Imagine paying less just to trade on software that slows you down.

- Payout Hoops: Delayed payouts, minimum trading days, hidden consistency rules…you name it. If you can’t actually access your profits, what’s the point?

- Moving Goalposts: Vague or shifting rules that make it harder to pass prop firm evaluations and qualify for funding.

It’s like trying to fill a bucket with holes in the bottom. Reset after Reset, hundreds in fees, and by the time you realize it, your profits have drained away.Sure, you can get in the door for cheap, but if that door leads to a maze of obstacles, was it really worth saving a few bucks if all these rules could cost you thousands in payouts?

Value vs. price in prop trading

When choosing a prop firm, the question shouldn’t be “What’s the cheapest?” It should be:

- Can I actually get a payout here?

- Are the rules clear and fair?

- Does this firm want me to succeed or Reset forever?

Some prop trading firms stand out by offering trader-friendly conditions, such as straightforward rules, high profit splits, and trader support.

Most traders know the sting of watching profits disappear. Not just from bad trades, but from bad rules. That’s the real cost of “cheap.”

Imagine grinding for weeks, finally hitting target, only to find out you didn’t meet a hidden rule. That’s not just frustrating. It’s the payout you should’ve taken home, gone before it ever reached your account.

And that’s exactly why choosing the right prop firm matters. You need a prop firm that will help you build consistency, grow your skills, and take home profits. That’s where value beats price every time.

Why Topstep is the best value Prop Firm

Topstep was built for one reason: to give traders a fair shot at funding. We’ve been doing it 12+ years, and we’re proud to have the best payout policy in the industry.

Here’s what that means for you:

- Fast, Consistent Payouts: You only need 5 winning days of $150 or more to request your first payout. Get Paid Weekly and take payouts up to $5K or 50% after.

- Clear, Transparent Rules: Follow the rules, hit your targets, and trade with consistency. That’s it.

- Risk Management Features: Tools like Account Lockout and Daily Loss Limits are designed to help you trade with discipline, so you can get funded and stay funded.

- Community & Coaching: From TopstepTV to our Discord of 150,000+ traders, you’re never trading alone.

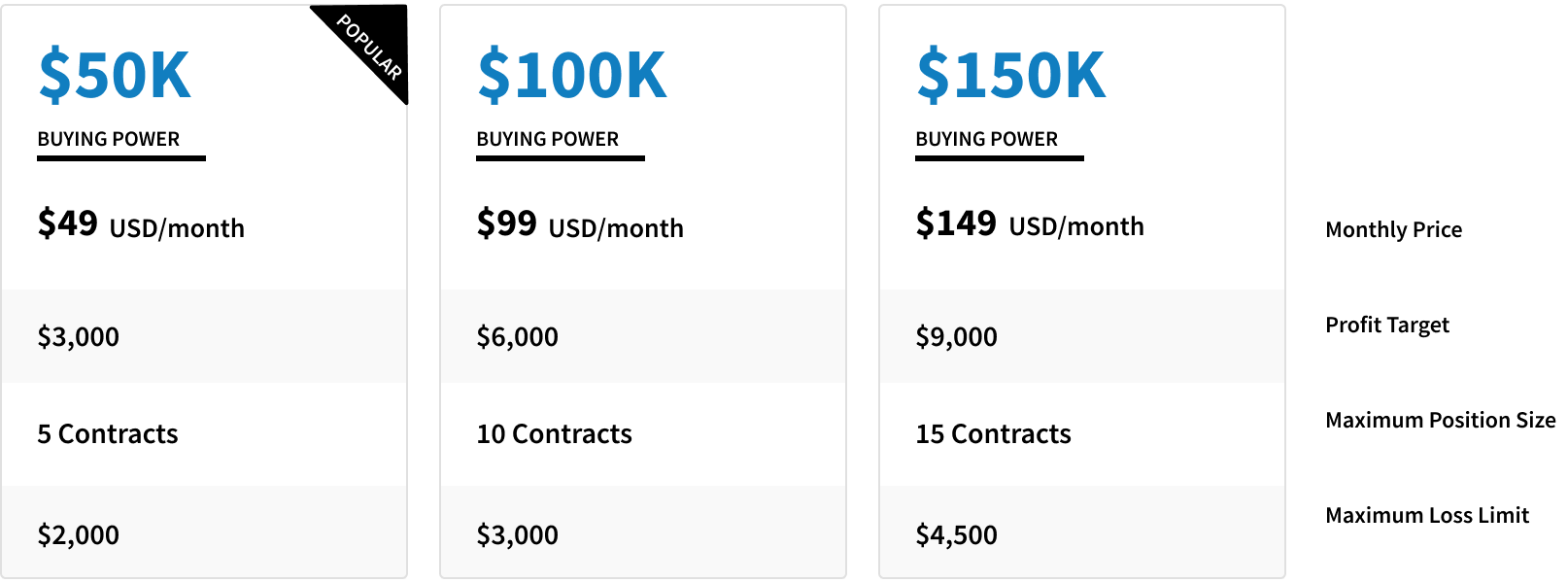

And yes, our pricing is competitive. Our Standard Trading Combine account starts at just $49 with $50K in buying power. That may not be the cheapest on the market, but it’s the best value because at Topstep, your path to a payout is actually real.

And if you slip up and lose your Express Funded Account before that first payout? You can stay funded with Back2Funded and keep your shot at a payout.

The $20 prop firm trap

So, let’s circle back. You see a prop firm running a promo: $20 to start. Tempting, right?

But here’s the reality check:

- If the rules are designed to trip you up…

- If the platform slows you down…

- If the payout process makes you jump through hoops…

Then you’re not trading. You’re stuck in a setup you were never meant to win. That $20 “deal” might look cheap, but if it keeps you from collecting $2,000, $5,000, or even $10,000 in payouts, it’s the most expensive mistake you’ll ever make.

Saving money up front isn’t much of a bargain if it costs you thousands in missed payouts later.

At Topstep, that’s the value we deliver: clear rules, a fair shot at funding, and the strongest payout policy in the industry.

Ready to trade where payouts are real?

Frequently asked questions

What hidden costs should traders watch out for with cheap prop firms?

Hidden costs often include frequent Resets, vague rules, delayed payouts, or limited platforms that prevent traders from accessing their earned profits.

Are cheap prop firms worth it?

Not always. Sure, the low entry price looks good up front, but hidden rules like intraday trailing drawdowns or strict payout policies can make it harder to succeed, costing traders more in the long run.

Why choose Topstep over the cheapest prop firm?

Topstep provides clear rules, weekly payouts, advanced risk management tools, and a supportive community, making it a better long-term value than simply chasing the lowest cost.

How much does Topstep cost?

Topstep’s Standard Trading Combine starts at $49 for a $50K account, offering competitive pricing along with real opportunities to earn payouts and grow as a trader.