I’ve frequently observed that when traders are at the most primitive stages of the craft, they will often fall into one of two simple categories. The first designation includes those without experience or thorough research who believe they have determined their distinct trading personality and the exact timeframe that suits them. The second category is those who never considered during which timeframes they ought to trade (and hold trades) but instead leave it all to chance.

The fact is, traders in the beginning stages likely don’t have the experience or well-rounded perspectives to define themselves in such a detailed way as to know which timeframe works for them. Simultaneously, those traders who have given it no thought have neglected a significant consideration.

Furthermore, the determination as to which timeframes work best for the traders is not only relevant to those who are raw beginners; it is a question that continues to require navigation as traders continue to trek through the adventure of moving from early, inexperienced, and usually profitless, trading, into more seasoned, consistent, and profitable traders.

For the sake of this article, I will delimit the discussion into three timeframes for traders to consider.

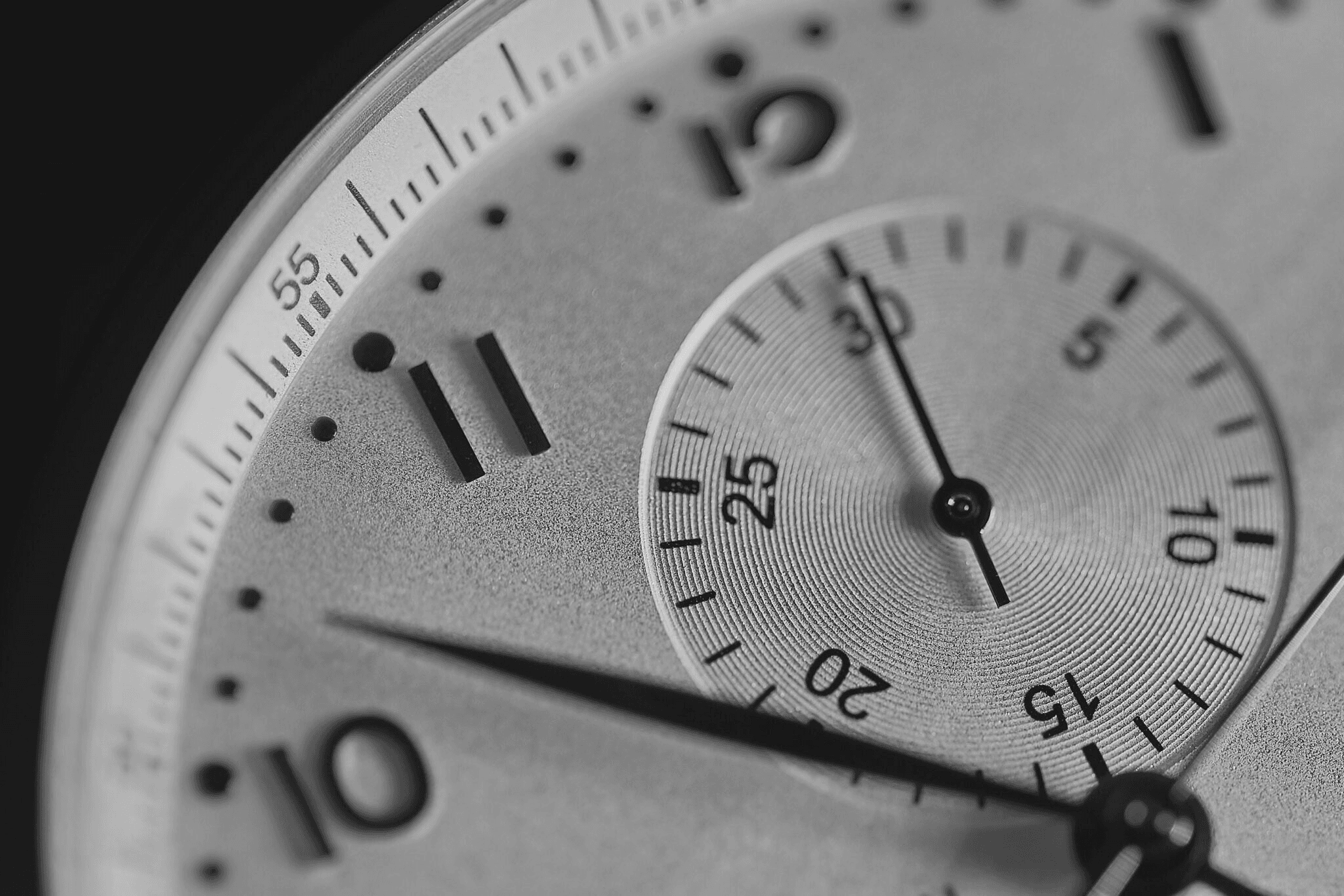

3 trading timeframes

First are swing trades. This is typically when a trader enters a position and then holds that position overnight, sometimes for a period of days. Although some swing traders will exit trades the next day, others maintain trades for days, weeks, and even months. For this discussion, I will lump any timeframe that’s held overnight into the category of swing trades.

The scalpers are the next trading timeframe and the polar opposite of the swing traders. This style was originally so termed on behalf of the market exploiters who, in the past, largely used to be able to buy somewhere near the bid and sell somewhere near the ask, collecting the margin in between. This is not an option for retail traders, which includes my readers. When I use the term “scalp,” I intend it to mean a very short-term trade, lasting from seconds to sometimes minutes, probably no more than five minutes on average.

The third trading timeframe relates to a style that I’ll identify as intraday positioning. This amounts to a blend of the first two styles. Rather than being in and out of positions constantly throughout the prime opportunities of a trading day, this style sets the trader up to carry just a couple of trades held for longer durations. Sometimes the timeframe might be thirty minutes, an hour, or even the majority of the day, and typically the position is closed by the end of the day.

5 trading timeframe considerations

If you are considering which style may suit you, then continue reading. The next section of this article will define some of the personal characteristics along with external variables necessary to consider which trading timeframe may be best for you.

Time Requirements

The first assumption I’ll make is that if you are not a heavily experienced trader, and are still trying to find your edge, then you probably aren’t a computer programmer able to compensate for the time investment by automating your strategies. If you are like most of us, you are doing it all manually.

As such, your time availability plays an important part in determining which timeframe may be most suitable for you. This means not only what time you have available and can devote to trading but also how much time you desire to give to the craft.

Unsurprisingly, if you are scalping, then you’ll likely have to be glued to a screen. However, you can gain back some time by delimiting the best scalping opportunities for your market. In many cases, this is going to be the most active time of day.

For example, when trading equity index futures, often this would be in the first two hours of the regular trading session. In this scenario, you may be able to adequately trade by investing just a couple of hours of screen time per day. However, during those two hours, you will need to give intense, undivided attention to your market.

If you are an intraday position trader looking to capture somewhere around 50% and more of an average day’s range, then you’ll likely need to be in front of the screens for a significant part of the day. It can take a considerable portion of the session to find your setup. Then, unless you program your exits (which is a viable option), you’ll be monitoring an open trade for a significant part of the day.

Expectedly, if you are a swing trader, then you probably will have to invest the least amount of screen time. You may look for a setup early and late in the day, and then when entering a trade, you will likely have flexibility as you are anticipating larger targets and less active management.

Personality and Habits

I have frequently found that a trader’s personality and habits will determine which trading style they prefer and will be successful in implementing. Some will drive themselves crazy in a scalping environment but will experience much more clarity when swing trading. Meanwhile, others feel too passive when swing trading and can only captivate their energy when intensely engaging the markets via scalping. I’ve never seen anyone completely retrain their personality, so I suggest you find yours and go with it.

Additionally, in terms of habits, I’ve found that some people enjoy a robust social life, while others have a stringent exercise routine that includes outdoor running every day. Meanwhile, others sleep during the day and are awake in the night. However you approach life probably has some merit to you, but your trading will need to be compliant with your personal habits.

Commissions, Broker, and Platforms

Brokers and platforms are interchangeable enough that you can consider which fits your trading style. However, I wanted to clarify that certain brokers and platforms will appeal to you (or lack appeal) depending on your trading style. This applies most particularly applied to scalpers. The likelihood is that you will be making many trades, and when doing so, you need to have competitive commissions.

If you look at the average futures commission compared to the fees from the more experience brokerages, then in 100 trades, which a scalper can easily surpass in a week, if not just a couple of days, the difference in fees between different brokers can amount to hundreds of dollars. Furthermore, with your platform, the more sophisticated your trading system, the more likely you’ll need a platform that can accommodate your needs.

Types of Markets that Work For Each Trading Style

You may need to adapt your style to fit your preferred market or change your market to fit your style. For example, if you are trading a less liquid contract with a wider bid/ask spread, then it will likely be a less viable option for scalping.

If you are trading a market-like equity index futures, then you can probably trade any timeframe reasonably. However, if you are trading the two-year treasury note future, then unless you have some deep pockets and comparable experience, you probably aren’t going to scalp this market; instead, it would be most suitable for swing trading.

Account Balance

With the advent of mini and micro contracts, the account balance is less significant a factor than in the past. However, it’s worthwhile to consider how your account size could weigh into your system. For example, if you have a small account, then swing trading may not be for you, as your stop loss generally has to be wider on longer-term trades. Meanwhile, when scalping, you probably will employ minimal risk if you are trading responsibly.

Alternatively, if you are swing trading a micro contract, you may have the room to give an adequate protective stop, and if you are scalping a midsized or larger contract, then you may not be able to absorb the eventual five losses in a row. These variables are just a few of the necessary considerations you must make.

The ball is in your court

As with any informative material, it is up to the reader to take the data, modify it, and adapt it to serve your needs, personality, and unique trading style. This is not an all-encompassing presentation but does engage many of the necessary qualifications for determining which trading timeframe may work best for you.

Furthermore, it may be that you can incorporate multiple types of timeframes into your trading style. For example, if you have swing positions, you can then also utilize some of these intraday strategies. Additionally, with the opportunities made available by programmed, computer-based trading, one might even be able to make use of all these time formats.

However, I encourage any strategy to be backtested and traded in simulation before activating a live account. You can’t be successful in live trading without being profitable in a simulated environment, albeit productive simulation does not imply a guaranteed profit in a live market.

Lastly, you can be successful regardless of the holding period with certain trading attributes. Alternatively, when specific variables are neglected, you will be unprofitable regardless of the timeframe you trade. Critical facets include risk management, an appropriate risk-to-reward ratio, and other elements of a trading plan, which are most likely to determine your fate. Therefore, as you seek to fine-tune your craft and delimit your own trading style to a specialty, you can’t afford to neglect these other matters.

Until next time, trade well!