Home › Market News › Topstep Trading 101: Flag Patterns

The purpose of this series is to educate newer traders on the basic principles and techniques of technical analysis. To a lot of you, this is old news, but for the rest of you, we are here to help you build a solid foundation for reading chart patterns.

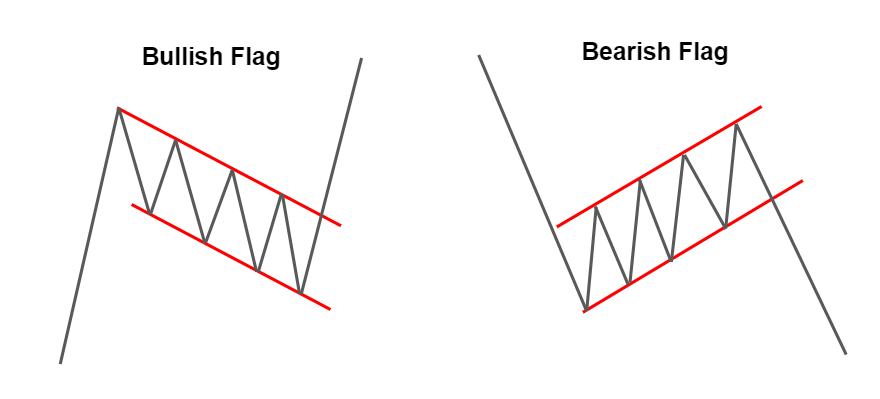

The Flag is one of the most common chart patterns found in technical analysis, and can represent either a bullish or bearish continuation setup. This shorter time frame setup usually forms mid-trend and represents a temporary pause, or consolidation, that moves counter to the prevailing trend. Some traders will simply call them pullbacks.

While the frequency of flags appearing on your chart will make them visible without having to draw lines, there are still some key characteristics to look for when attempting to identify a possible flag pattern. You will need to be cognizant of the direction of the prevailing trend, volume patterns, size and duration of the consolidation period, and possible breakout levels.

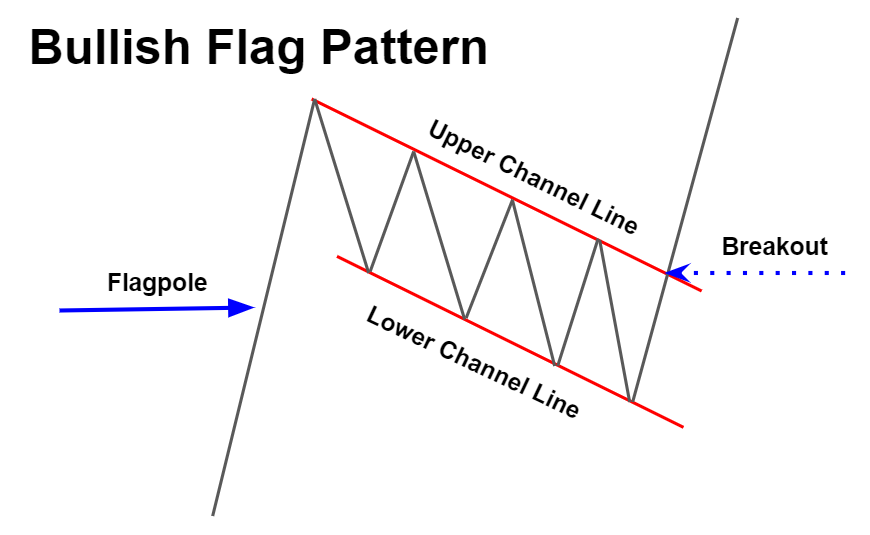

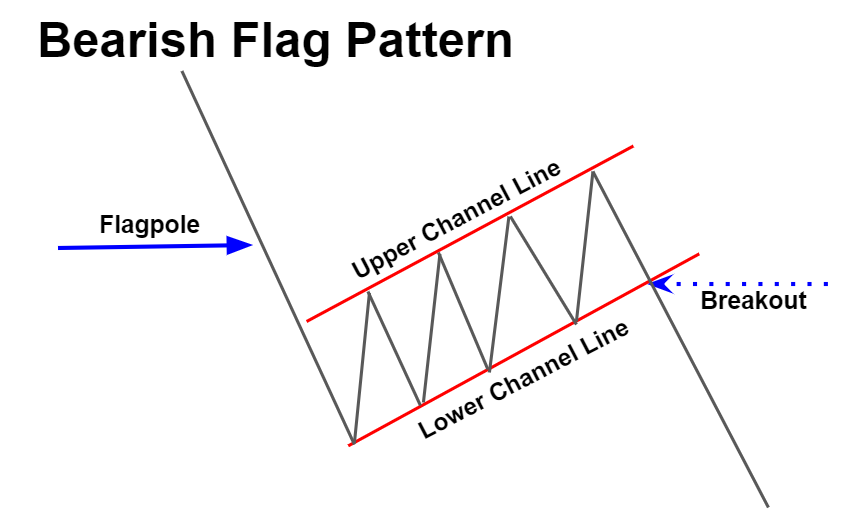

A flag is drawn using 2 parallel lines (channel lines) moving in the opposite direction of the underlying trend. In an uptrend the channel slopes down, and in a downtrend the channel slopes up. There is no minimum or maximum number of reversal points required to confirm this pattern, but historically the duration should not exceed 20 price bars.

The preceding price move leading up to the flag formation is commonly referred to as the pole, or flagpole. The retracement from the starting point of the flag should not exceed more than 50% of the flagpole. Anything more than a 50% retracement would then be considered a change in trend. However, flags very rarely result in a change in trend, so they are considered to be one of the most reliable charting patterns out there.

Flag patterns are dependent on both volume and price for confirmation. After a steep rise or fall in price, volume should start to decline as the market begins to consolidate and move counter to the prevailing trend. Breakouts should occur on a significant spike in both volume and volatility.

The setups for both bullish and bearish flag patterns are very similar, with just a few subtle changes in direction and volume separating them.

When a bullish flag pattern is identified, aggressive traders will enter long positions at, or near, the bottom channel line, using new lows as both stop levels and areas to re-establish a position. More conservative traders, on the other hand, will wait for a price bar to close above the upper channel line on increased volume for confirmation of a breakout before initiating a position.

In recent years, retests of flag areas have become more and more common. Predator algos love to hunt stops, however, these programs do not operate with unlimited resources. Flag levels do become significant psychological support and resistance areas over time, so a stop above or below the highest or lowest point of the flag can be considered a safe zone.

Charting purists will say that the target price after a breakout should be equal in distance to the size of the move preceding the flag. This is, of course, debatable and disciplined risk management should always be practiced.

In conclusion, flags are continuation patterns, and should be traded as such. To properly identify this setup, volume patterns should coincide with price movements, and risk parameters should already be in place before initiating a position.

Trade Well!