Home › Market News › Topstep Trading 101: Triple Bottoms

The purpose of this series is to educate newer traders on the basic principles and techniques of technical analysis. To a lot of you, this is old news, but for the rest of you, we are here to help you build a solid foundation for reading price charts.

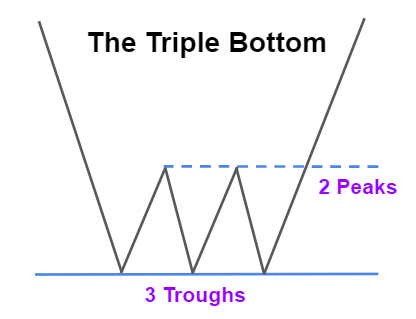

In this lesson we will be looking at Triple Bottoms. As the name states, the triple bottom formation is a chart pattern formed at market lows, and signals a potential trend reversal. This pattern consists of 3 troughs and 2 peaks, and can be found on any timeframe, but must be preceded by a downtrend.

The same characteristics that make up the Triple Top also apply to the Triple Bottom, they are simply reversed.

The weight of the triple bottom pattern relies heavily on the time it takes to form, and the size of the moves between peaks and troughs. The longer and wider the formation is, the more reliable the reversal pattern becomes. Price, time and volume are all key components for this setup.

Triple Bottoms are commonly found at key support areas, and represent multiple unsuccessful attempts of sellers to break below that level. Because this pattern represents a period of price consolidation, it can easily be mistaken for a rectangle formation while it is setting up. The difference between the triple bottom and the rectangle is that the triple top can only have a maximum of five reversal points, while a rectangle has no limit on reversal points.

You should be able to easily draw a lower trendline connecting the lows, and an upper trendline connecting the highs of the pattern. The upper trendline will represent resistance while the pattern is forming, and will change to a key support level after a breakout is confirmed. The lower trendline will represent support while the pattern is forming, and will become key resistance if the pattern fails.

Similar to other reversal formations, volume patterns should match up with price to give further confirmation. The first trough should be made on significantly higher volume than the following two, with a noticeable decrease in volume around the peaks. A breakout should then occur in tandem with a spike in volume.

Prices at the troughs don’t need to be an exact match, but multiple price bars closing below the lower trendline will more than likely lead to a failed pattern. A price bar closing above the upper trendline on high volume will signal a breakout. A second price bar closing above the upper trendline will confirm the pattern.

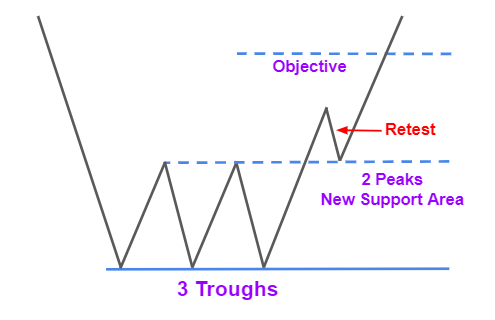

The measured move for a triple bottom is the distance between the lowest trough and the highest peak. This distance should then be measured upward from the breakout point to determine the price objective.

Confirmation of the triple bottom must be made with a price bar closing below the lower trendline before a position should be initiated.

The resistance line connecting the two peaks turns into a resistance level after the breakout has occurred, and it’s common to see a retest of this level before the price objective is met. More aggressive traders will often use a retest as an opportunity to add on to their position if the volume and time patterns are also signaling a strong probability of continued trend reversal.

The most obvious place to put a stop would be just below the lower trendline. If sellers make another run at lower prices, the probability of the support line holding a fourth time is low, and the pattern is most likely broken, so a continuation of trend can be assumed.

Another stop area could be the 50% retracement level from the breakout. Since the resistance line connecting the two peas becomes a significant support level after the breakout, a conservative stop area would be the midpoint of the formation. It’s also safe to use bollinger bands or short term moving averages as stop levels.

There is no substitute for discipline and proper risk management when it comes to exiting a trade.

Trade Well!